Govind Gupta and Badri Narayanan Gopalakrishnan

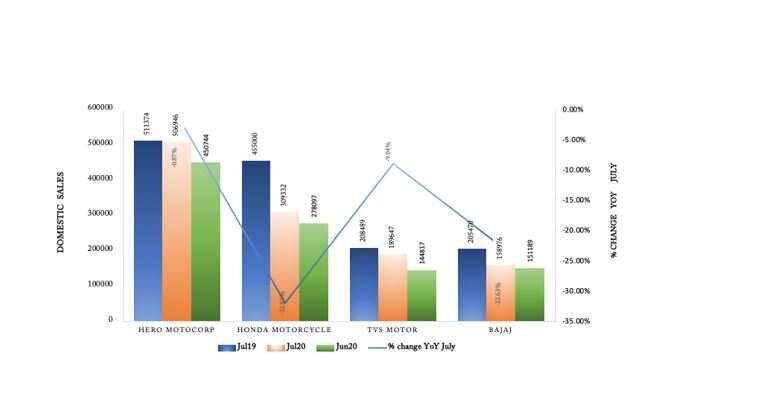

Across both the two-wheeler and four-wheeler segments, sales rebounded and for Hero MotoCorp, TVS Motor Company, Hyundai, and Maruti Suzuki, inched close to July 2019 dispatch numbers. While this hints at a recovery, long-term trends are hazy as these numbers are fueled by pent-up demand during the lockdown and the sanguine sentiments among retailers as they restock inventories for the upcoming festival season, expecting bumper sales. In the July 2020 report, ICRA maintains its negative outlook of contraction on a Y-o-Y basis for both the CV (commercial vehicle) and PV (passenger vehicle) categories.

2W sales pick up in July 2020

Despite an expected contraction of the industry in FY21, the long-term outlook is not grim as certain sectors appear promising. Going forward, in contrast to the four-wheeler or passenger vehicle segment, for which a lot will rest upon the pace of recovery to normalcy, the prospects for the two and three-wheeler segments appear solid.

The uptick remains in the 2W category due to favorable expectations from the rural and semi-urban economy. Owing to a healthy rabi output, high farm income and relatively lower COVID impact, the demand outlook remains positive. Motorcycles form 2/3rd of the 2W market and are the first mass choice for short-distance mobility due to its affordability. Sales of entry-level scooters and motorcycles rallied the most during May-July 2020. Much of the demand is from migrants who are back in their native villages and are looking for affordable mobility options.

As social distancing is the new normal, people wary of public transport will shift to small format mobility, primarily to two-wheelers. In urban areas, motorcycles and scooters align with safe personal mobility needs and are the preferred transport of the emerging Indian middle class as they require only small parking space and can cut through traffic efficiently.

Drivers of medium and long-term growth

From April 2020, India leaped to mandated Bharat Stage -VI (BS-VI) standards of vehicular engines directly from Bharat Stage -IV (BS-IV). This created daunting challenges for Original Equipment Manufacturers (OEMs) of diesel vehicles and increased the cost of ownership for the consumers.

“Motorcycles form 2/3rd of the 2W market and are the first mass choice for short-distance mobility due to its affordability.”

All motorcycles run on petrol. This enables the 2W OEMs to better adapt to the BS-VI shift. Petrol engines emit far lower PM and NOx than diesel, and hence just need a larger catalytic converter which is cheaper. Honda, a forerunner to the new standards, has capitalised on this edge and has sold over 4.5 lakh two-wheelers in Q1 of 2021.

The government, through its Faster Adoption and Manufacturing of Hybrid and EV (FAME) programme, provides massive impetus to this transition and the 2W market stands to gain from it. In the Electric Vehicle segment, four-wheelers constitute only 10% of the market while 2Ws and 3Ws account for the rest 90%. The programme incentivises both consumers and companies, through purchase subsidies and investment assistance. This is still a nascent marketplace, but a major disruption in commute, has made the ground fertile for faster adoption of electric vehicles and increased consumer readiness for them.

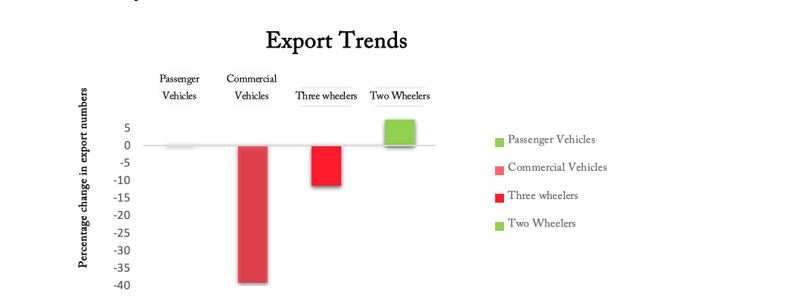

“India is the world’s largest 2W manufacturer and the export trend in the segment has been robust and dominating over other vehicles.”

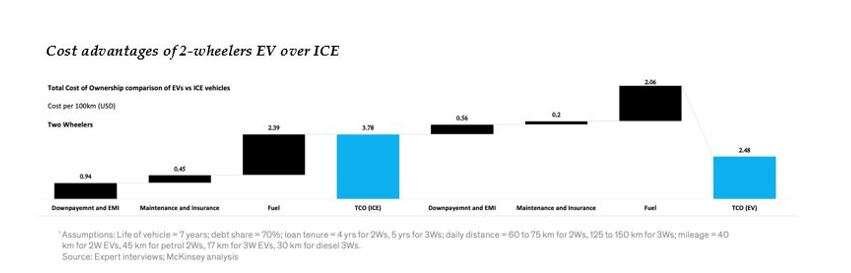

A World Economic Forum report posits that with India’s current low vehicular penetration of only 20 vehicles per 1,000 people and a burgeoning middle class, a major demand will bypass the ICE (internal combustion engine) vehicles and significantly expand the electric mobility market. Thanks to the cost advantages of electric two-wheelers over ICE vehicles, they are expected to constitute 35% to 40% of all 2Ws sold in India by 2030

Cost advantages of electric 2Ws over ICE

While the demand for four-wheelers in the rental and ride-sharing market segment remains repressed, a McKinsey report forecasts that the demand for the last mile delivery vehicles will rise on the back of the growing e-commerce sector and home delivery services. Two-wheelers fit the affordability and efficiency criteria for such trips.

Finally, as per ICRA, the credit profile of 2W manufacturers is characterised by strong balance sheets with negligible debt and strong cash and liquid investments. This makes the OEMs in this sector resilient to disruptions by providing breathing space during the short-term crisis and prospects for recouping recovery. With resilient financials, firms can invest in new product developments required to shift to BS-VI standards or EV.

The way ahead

India is the world’s largest 2W manufacturer and the export trend in the segment has been robust and dominating over other vehicles. In FY20, while passenger vehicle exports increased only marginally by 0.17%, 2W exports registered 7.30% growth. Analytical reports indicate that the long-term outlook will be favorable. The 2W industry can capitalise on its edge and expand exports by developing a competitive product portfolio.

(Govind Gupta is the co-founder of IFSA Hansraj College, New Delhi and researcher, Infisum Modeling India Pvt. Ltd. and Badri Narayanan Gopalakrishnan is the Founder and Director of Infisum Modeling Pvt Ltd, India)

This post was originally published in ETAuto.com