Badri G. Narayanan, Rahul Sen, Sadhana Srivastava, and Sowmya Mathur

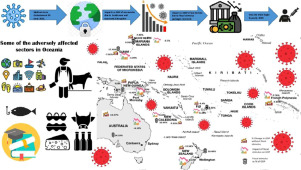

The covid-19 pandemic has led to an adverse impact on the economy which necessitated several governments to respond to the unprecedented economic shock with a full/partial lockdown of economic activities, using fiscal stimulus packages and expansionary monetary policies to support the economy in the short term. However, empirical evidence on whether these measures are likely to cushion the adverse impact upon the economies and the key industries affected by them has been less forthcoming. So as to ascertain the economic and sectoral impact of fiscal support measures in countering the external shock for eight affected economies in Oceania.

The global computable general equilibrium (CGE) method was used to understand the economic impact of a fiscal stimulus shock, and modelling our scenarios based on IMF World economic outlook projections, combined with the fiscal stimulus packages offered to counter this global health pandemic’s recessionary effect.

All countries in Oceania experience a decline in their output, exports, and investment without fiscal stimulus support. New Zealand real GDP plummeted by -13.6%, the highest in the region, while that for the Pacific-island economies dropped to -8%. The economic impact of fiscal stimulus sees a rise in GDP, New Zealand (21%), Guam (17%), and Australia (14%) provide the most prominent fiscal stimulus packages as a proportion of GDP. As a result, welfare and real GDP losses are mainly cushioned in New Zealand and Guam (-3.1%). A smaller fiscal stimulus to GDP for Australia cushions an otherwise adverse output decline of -8.3 to -6.2% in the medium-containment scenario. Contrastingly, the absence of a fiscal stimulus in French Polynesia and New Caledonia leads to a sharp decline in their real output to about 8% in a medium-term scenario.

The sectoral impact in the presence of fiscal stimulus for seven key industries, namely, Dairy, Fishing, Meat, Forestry, Education, Recreational and Accommodation, food and retail services. Education services, as well as Tourism (including recreational as well as accommodation and food retail services), seem to be the worse impacted industries across Oceania, experiencing a short-term output decline of -25% in education services and -s14% in tourism-related recreational services for New Zealand, the sharpest among the countries studied. Fishing, meat, and meat products are also affected adversely across all countries to a comparatively lesser extent (the Northern Mariana Islands and French Polynesia being an exception). The dairy sector gets a significant boost in output due to fiscal stimulus in New Zealand but declines elsewhere.

Education services and Tourism industries suffer large declines in output due to the pandemic’s adverse effects from the maximum decrease in demand for skilled labor, worsening all COVID affected economies in Oceania. This decline is the sharpest for New Zealand among the countries studied, ranging around -19% for education services, -11% for accommodation and food retail services, and -7% for recreational and cultural services related to tourism. Australia, Guam, and Fiji witness a smaller but sharp decline in demand for skilled labor in these industries. Adverse effects for the demand for unskilled labor are observed for fishing, dairy, and meat in French Polynesia, wherein fiscal support was absent. Thereby confirming job losses in education and tourism-related sectors even in the presence of a generous fiscal stimulus.

It confirms that COVID-19 on output’s adverse impact is cushioned through a large fiscal stimulus package wherever offered. This package would still be inadequate to avoid unemployment and job losses in tourism and education services in Oceania, with continued support essential for their survival in 2021.