Sandesh Dholakia and Badri Narayanan Gopalakrishnan

With the current upheaval in diplomatic ties between New Delhi and Beijing, we look and analyze how AtmaNirbhar is really in the Auto Sector and the ways the industry has been impacted owing to humongous supply chain disruptions that the Galwan Valley situation has brought with it. As enticing as it may sound for India to be self-reliant, especially from what China is exporting to us, the numbers beg to differ significantly in China’s favor, at least for now.

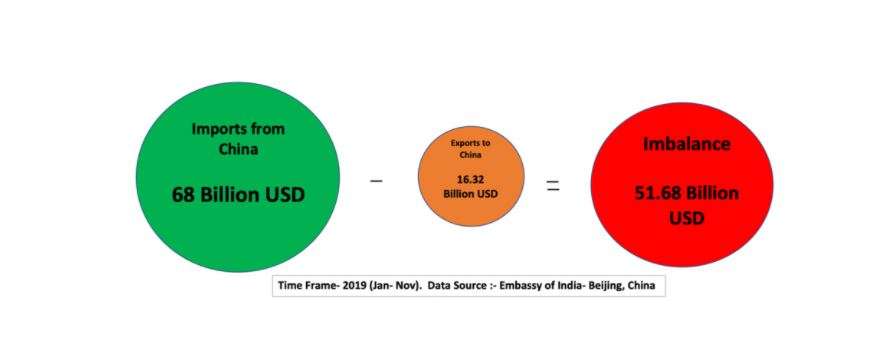

The latest official figures from the Indian embassy in Beijing, China, show export of USD16.32 billion worth of goods and services from India to China while the imports from China to India stood at USD68 billion, indicating a very high current account imbalance of USD51.68 billion.

After the sweeping nationwide Anti-Chinese sentiments, the trajectory of the imbalance seems to be shifting in favor of India, but the numbers still indicate us far from being AtmaNirbhar in a real sense.

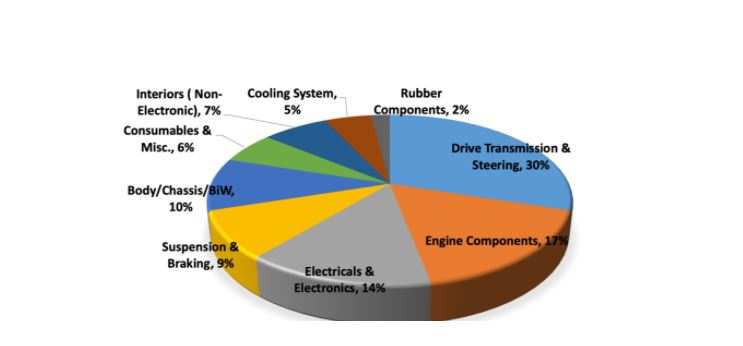

The Indian automotive industry has been mainly importing components like suspension & braking, body/chassis/BiW, drive transmission & steering, engine components, and cooling systems from China.

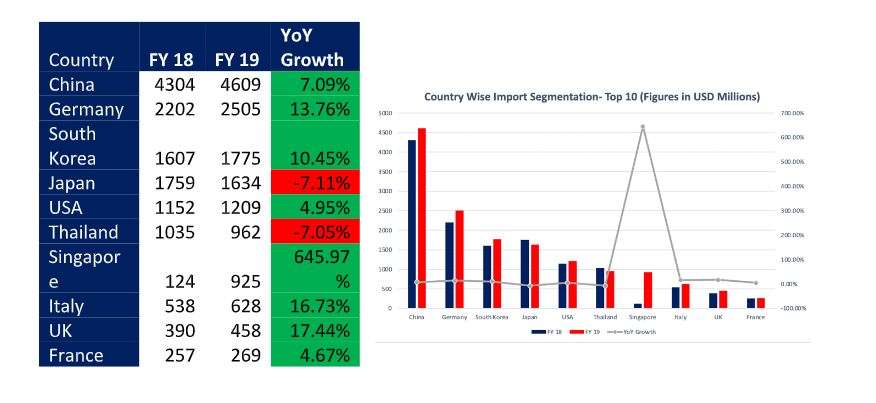

In FY19 the total imports for auto components were at USD17.6billion. Among these figures, China happens to be the largest exporter of auto components to India. Out of the entire pie, 27% of India’s auto part imports, including engine and transmission parts, came from China, according to data from the Auto Component Manufacturers’ Association of India (ACMA)

No other options

The foreign reliance of the automotive industry doesn’t end here. In 2020 the Indian automobile sector saw the highest Foreign Direct Investment (FDI) of about USD988 million followed by metallurgical, electric equipment and services.

“We don’t import because we like to, but because we have no choice,” said RC Bhargava, chairman of Maruti Suzuki India Ltd, the country’s biggest carmaker. On delving deep into finding the reason as to why there is not much of an option, we find that the industry was forced to upgrade from BS-IV emission standards to BS-VI emissions in three years, a time frame very short to allow the industry to set up the cost-effective domestic supply chain. This forced the sector to look out for cheaper and efficient global supply chain alternatives.

Given the technical expertise of China, combined with its extremely cheap labor, the automotive companies found the country to be the best option to have trade with.

Over and above the constantly evolving bilateral arrangements, Trump and his policies also have a huge impact on the way business unfolds between India and China in the near future. The recent escalation of shutting down consulates in each other countries indeed doesn’t indicate towards an optimistic trading period any time soon. The industry is keenly looking at the upcoming US Presidential elections and the avenues that it brings.

Drawing an analogy from what happened with Iran, it is very much likely that amidst this tug of war, India, a strong ally of the US, comes out as collateral damage as further sanctions and tariffs involving trade with China come across. Keeping aside the nationalistic sentiments this can hurt the budget of the common citizens when they see an intense upward pressure in the prices of goods and services at least in the short run before things gradually settle in the longer run.

The Caixin China General Manufacturing PMI, an Index which measures the performance of the manufacturing sector and is derived from a survey of private 430 Chinese industrial companies, rose to 52.8 in July 2020 from 51.2 in the previous month, beating market consensus of 51.3. The IHS Markit India Manufacturing PMI, an Index which measures the performance of the manufacturing sector and is derived from a survey of 500 Indian manufacturing companies, declined to 46.0 in July 2020 from 47.2 in the previous month.

The numbers clearly show that while China has recovered almost entirely in its core manufacturing business, India still struggles to overcome the COVID-19 scar and thus the need to be more cost-efficient in its operations.

Rajan Wadhera, President, Society of Indian Automobile Manufacturers, said in a note, “Inordinate delays in clearance due to congestions at the port could impact the manufacturing of vehicles. The industry is piecing itself together as growth is limping back; any further disruption now is best avoided.”

The electric vehicles segment, a rapidly growing market in India, seems to be getting affected the most because of the current situation. Most of the components for such vehicles, like lithium-ion batteries and cells, electric motors, are imported from China.

According to media reports, most of the low-speed electric scooters and three-wheelers sold in India have localization levels of only about 20%. They mainly rely on parts from either China or Taiwan.

The bottom line

Though numbers at this point suggest a not so favorable position for India, the market seems to be picking up quite fast, especially after many multi-national firms have decided to pull out their businesses from China and come to India. With the political constraints, there is not much that could be done except trying to keep things as gradual as possible to avoid massive disruptions that the industry can face if not given ample time to convert its global supply chains to more inward-looking and self-reliant.

(Sandesh Dholakia, co-founder of IFSA Hansraj College branch, New Delhi and researcher, Infisum Modeling India Pvt. Ltd. Dr Badri Narayanan Gopalakrishnan is the Founder Director of Infisum Modeling India Pvt. Ltd.)

This article was originally published in The Economic Times