Badri Narayanan Gopalakrishnan and Sumathi Lalapet Chakravarthy

As India battles its worst pandemic crisis, there will be a huge toll on the economy and the automobile industry, in particular, will take a hit. The initial estimates are scary, but the recovery could be expected with some timely government intervention.

While China shuts down its last makeshift coronavirus hospital, the world endures a bigger challenge as the pandemic is rampaging to every continent on the planet at a speed greater than the light.

Based on the John Hopkins coronavirus tracker, the novel virus COVID-19 has spread to an unprecedented 175 countries as of March 27, 2020. The world is grappling with uncertainties and several countries have imposed restrictions that would severely impact the economic activities not just for now, but for a prolonged period of time.

India still shows hope in terms of the spread of the infections and reporting a lower number of deaths. It remains one of the least impacted among the highly populous countries at present; there are just about 0.39 cases per million people: negligible in comparison with a staggering 1350 cases per million Italians or 258 cases per million Americans.

The timely decline in oil prices, shall be of great usefulness for the government to offer additional relief as for every 2 rupees per litre increase of excise duty on oil would result in additional revenues worth 0.1 percent to 0.15 percent of GDP.~

India’s decision to lock down the entire nation closing businesses, curtailing the movement of people for a period of 21 days and the “stay-at-home” order that followed to combat the spread of the contagion, has been well-appreciated by prominent leaders across the globe.

This move is predicted to be risky for the pace of economic progress as it slows down business operations and paralyses economic activity for a significant period.

India hardly affords another downward turn in the economy given the already persistent deceleration of its GDP growth in the last couple of years. However, such drastic measures are not only imposed by India, but also by several nations in the world including Italy, France, and many others to effectively manage the crisis and contain the spread of the virus.

The western world has been the worst affected at present with the USA reporting about 86,000 cases and Italy reporting about 81,000 cases as of 03/26. Compounded with 170,000+ cases in Europe and the UK excluding Italy, this is a true testament of current reality. This certainly has ripple effects across many nations in the world and will slow down the growth of all industries except for those in the healthcare sector at least for the next couple of months.

It is evident from the data that the aftermath of the pandemic is very uncertain as the number of people infected by the virus increases exponentially and followed by a period of sustenance. This calls for immediate policy changes and frameworks that zero-in on their mission to promote social distancing to fill the void that is being created in the economy.

Hon’ble Minister of Finance for India, Nirmala Sitharaman has announced a Rs 1.7 lakh crore relief fund to help the poor and migrant workers in the country, and other categories of people vulnerable to be deprived of access to the basic amenities needed to secure their survival on earth. The relief focuses on offering direct cash transfers and ensuring food security to the needy and to support them in handling the 21-day lockdown.

The timely decline in oil prices, shall be of great usefulness for the government to offer additional relief as for every 2 rupees per litre increase of excise duty on oil would result in additional revenues worth 0.1 percent to 0.15 percent of GDP.

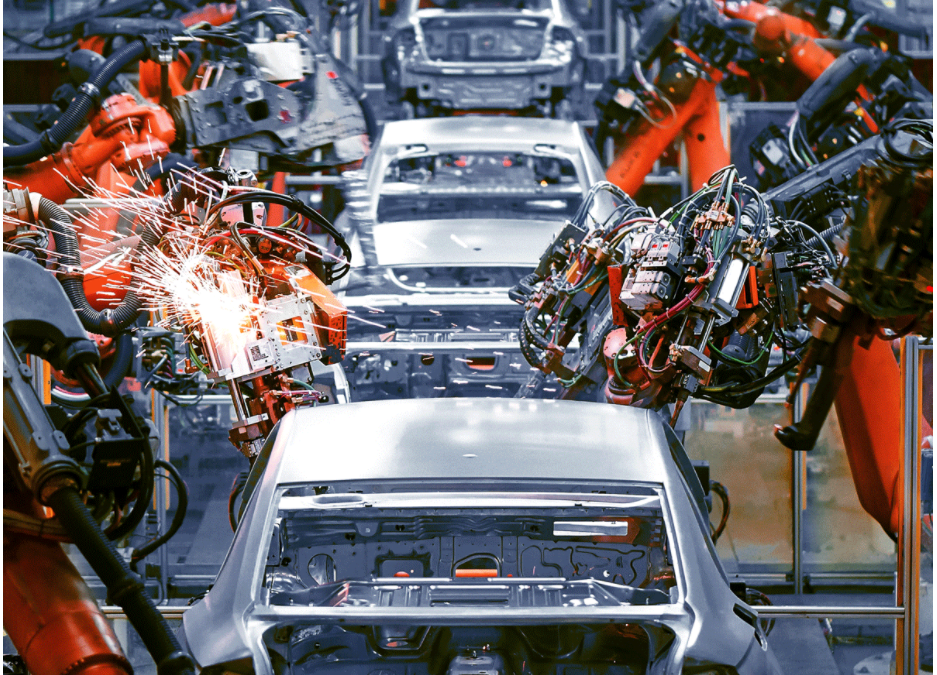

The auto industry is hit from multiple fronts: demand slump both domestically and exports, as well as negative global and domestic supply chain disruptions involving both forward and backward linkages.~

We discuss some findings from a study that we conducted using a widely used global economic model named GTAP, developed in Purdue University advised by a consortium comprising the who’s who of international organizations, top academia, consulting/auditing firms and governments across the world.

This model captures the global economic linkages between different sectors and countries, through the intricate supply chains and trade interactions at bilateral level for every pair of countries in the world. Such models have the unique ability to analyze the intersectoral transactions both from the supply side and demand side, and from a top-down perspective and bottom-up perspective simultaneously.

Following several studies by organizations like ADB, McKinsey, etc., we categorize the study on impact into different channels; firstly, tourism expenditure and travel industry are the most vulnerable to be affected and the impact is substantially huge; secondly trade and production are shut down in several sectors; thirdly, consumption is dipping all over the world. We examined these channels from a global perspective and more specifically, we analysed and projected the status quo to predict the effect of shut down in travel, tourism, trade and production until early June 2020 in India, based on what has happened thus far.

Our results suggest that GDP losses may be quite substantial amounting to almost Rs 7.47 lakh crore ($101 billion) and a large part of this fall is estimated to be from the reduced exports and consumption. However, almost a further $3.7 Lakh Crores ($50 billion) loss is averted, owing to the major decline in the oil prices reducing the cost of imports that are critical to the economy.

This result reinforces our previous observation that the economic stimulus package is partly a harvest of the lowering oil prices, by taxing fuels, which is a good reprieve from the otherwise bad news floating all around. Although oil price reductions are leading the OPEC countries to an economic catastrophe, India being a leading oil importer, may benefit from this development.

In another separate analysis that we executed using the same modeling framework, we also found that the economic stimulus package can pay off considerably, leading to about Rs 2.59 Lakh Crores ($ 35 billion) expansion in the GDP, because of the various channels such as reduced cuts in food consumption, income security amidst this crisis particularly for the poor and vulnerable population, etc.

Furthermore, the latest monetary policy measures announced by the RBI on March 27, 2020, may have a further stimulus of about Rs 25,000 Crores, even after accounting for its inflation effect. In other words, over half of the losses predicted in GDP may be compensated by the twin stimulus namely the economic and monetary packages.

A larger decline in imports of auto-components than that of domestic auto-components is expected.~

A deeper look at the auto industry in our analysis suggests that there may be a production loss of Rs 1.23 lakh crores in this period of shut down. The model also suggests that the decline in exports in the motor vehicle sector will be around Rs 51,000 crores.

Further, a study on the economic impact with respect to imported inputs to the sector reveals that the electrical and electronic equipment will be the most hit due to this global supply chain disruption. We anticipate a reduction of about Rs 4,600 Crore in imported inputs by the auto industry of these particular types of inputs, clearly mapping back to the disruptions caused by China’s prolonged shut down.

Within the domestic input market, the electrical equipment as well as iron and steel components may witness the maximum decline, amounting to Rs 22,000 crores. However, we also expect a larger decline in imports of auto-components than that of domestic auto-components; this is because of an increasing substitution of imported auto-components by domestic ones, in response to the global supply chain disruptions that make the imported auto-components either too expensive or just not available in sufficient quantities due to the shut downs elsewhere in the world. Last but not the least, the total domestic demand for the products from the automotive industry as a whole may witness a reduction of about Rs 74,000 crores.

In short, the Indian economy, much like many other economies today, is likely to suffer quite severely due to the ongoing Covid crisis. Auto industry is hit from multiple fronts: demand slump both domestically and exports, as well as negative global and domestic supply chain disruptions involving both forward and backward linkages. So, this is a story of a vicious cycle of demand and supply bringing each other down perpetually. The highly volatility prevailing in the ecosystem, and the aggressive lock down measures put forth by the several countries across the globe is predicted to strain not just India, but several leading economies making a long-lasting dent.

Nevertheless, industries, citizens and the government should work together on the combination of path to quick recovery, contained contagion and stimulus packages, to minimize this damage and avert its sustained worsening in future. We have illustrated that all the packages announced so far can substantially reduce the damage, but we need many more to come to completely nullify the damages over time.

(Badri Narayanan Gopalakrishnan is the Founder and Director of Infisum Modeling Pvt Ltd, India & Sumathi Lalapet Chakravarthy is a partner.)

This article was originally published in Economic Times